finbit$: I’ll admit it, I’m a Swiftie!

A $5 billion economy is not bad for a country. In fact that number ranks you in the top 50 economies worldwide. Although this “mobile economy” is not a country, more like a phenomenon. Yes I had to work in Taylor Swift this week. Her ERA’s tour is not only the biggest thing going, but move over Elton John it could be the biggest concert tour ever. She opened in Glendale, AZ this past spring of 2023, and her first show brought in more moolah then the Super Bowl which was played in February in the same stadium. In fact she’s been playing the equivalent of 2-3 super bowls every weekend for the last 6 months (I bet Travis couldn’t play that many super bowls). Analysts expect her earnings from the ERA’s tour to surpass the $1 billion mark by March of 2024 and possibly $5 billion of revenue for the cities she takes over! Shockingly, analysts are wrong a lot, but I have to put this educated guess in the “Strong Buy” category. She’s a machine! Swift writes her own songs, is protective of her music via streaming, and is re-releasing her songs to reclaim her master rights. Awesome! If your daughter, son, or grandpa needs a role model then I’d consider becoming a Swiftie. Recently she’s been rumored to be dating Travis Kelce, all pro tight end for the KC Chiefs. I love Kelce, but dude she’s way out of your league. My guess is that Taylor will “shake off” Travis faster then a middle linebacker blows up a receiver crossing the middle. Sorry Kelce, we know “All Too Well” that Swift is “Fearless” and may not fall for your “Sweet Nothing(s)”. Ok I fit in half a dozen songs, that’s enough. Stay tuned to see what happens next to America’s latest power couple.

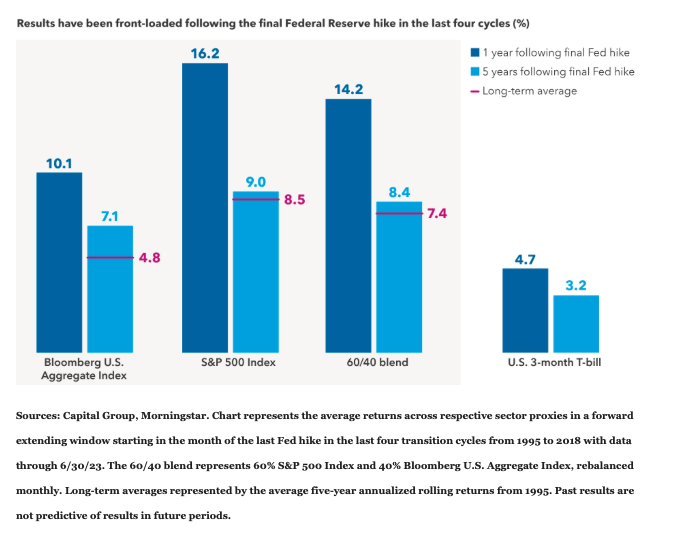

Yes, yes I know we barely averted a government shutdown this past weekend. And yes increased inflation is hanging around. And the Denver Broncos are a complete disaster. And last year was a bit of an outlier in the markets, since it was the first time in 45 years that both stocks and bonds posted negative returns. The Fed was aggressively raising interest rates to cool off inflation, but will they continue with the increases? Inquiring minds want to know! It seems the Fed is signaling they are pausing rates at the 5.25%-5.50% range. And they might be near the end of rate hikes, so the question is now what to do with your boatload of cash? I am not giving investment advice because everyone is different. Nolo Advice-o! What I’m showing you in the chart below from the Capital Group is what has happened after the last four rate hike cycles. Wow fascinating!!

If rates pause or even retreat a smidgen in 2024 it can help both stocks and bonds theoretically. As companies and consumers see their borrowing costs flatten and maybe even decline, it provides a boost to the economy and corporate profits. Historically, equity investors have seen the benefit. The bond market might also benefit if rates retreated and you owned bonds that were paying a higher interest rate then the current rate. What I’m saying is sometimes you have to be patient and look at history. Nobody knows what the next 12 months will look like in the markets, so sticking to your long term plan may be the best non-move you ever made!

Hey JB?

Hey JB - I’m 33, married, my fantasy football teams stinks, and we now have a 10 month old son. I’m not blaming Junior for my draft woes, but next year I’m definitely not taking a punter in the first round. My wife says I need to quit sports betting and get some life insurance in case I ski off the wrong cliff this winter. Harsh, I know! My buddy keeps pushing me on this whole life insurance, but it seems like a whole lot of money. What should I get? What’s right for our family? - signed “Shoulda taken Mahomes”

Dear “Shoulda taken Mahomes” - The answer is ALWAYS take Mahomes for your fantasy league. As far as life insurance, it is not a one size fits all. How much you need depends on how much you want to protect and for how long? How much do you earn? How much do you spend? What debt obligations do you have now and in the future? Kids college, mortgage, weddings, income replacement... Start with what you need to cover these obligations and then back into an amount. For young families, 20 year term insurance is an inexpensive way to cover your loved ones if you pass away prematurely... aka go off the wrong cliff. Talk to an objective financial planner to help determine the amount and type before you look at products.

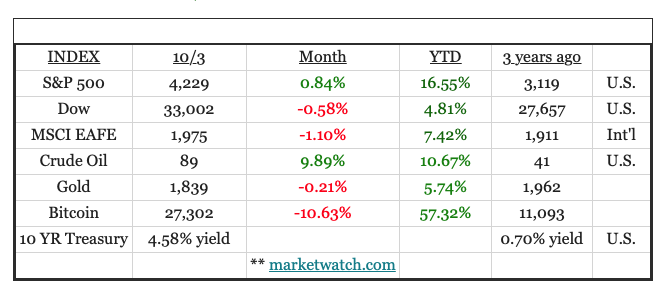

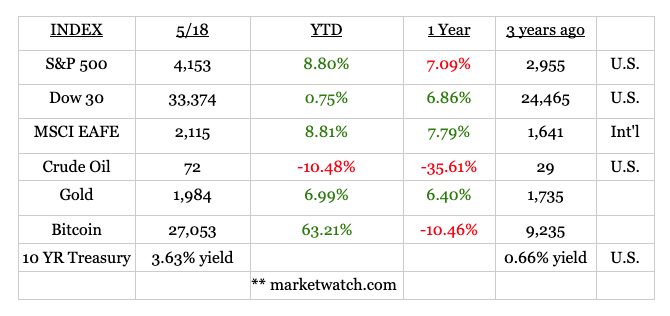

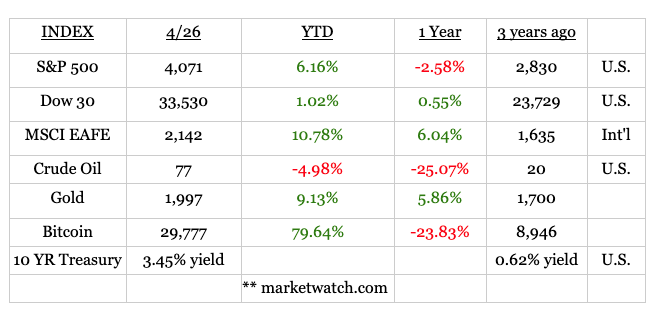

market bit$

quote bit$

“This year I invested in pumpkins. They’ve been going up the whole month of October and I got a feeling they’re going to peak right around January. Then bang! That’s when I’ll cash in.”

- Homer Simpson (dimwitted donut eating dad of Simpon’s cartoon fame)

finbit$: It won’t always be accurate and it needs improvement.

“It comes with critical limitations: It won’t always be accurate, and it needs improvement.” No this isn’t my wife describing me to her friends, family, and her tens of followers on TikTok. This reflects the meteoric rise and complex issues with generative artificial intelligence. Open AI, Microsoft, Alphabet (aka Google) and many others are racing to put forth their own version of AI. But like me it has limitations and it may be years before it is a useful tool for businesses. Even with AI’s limitations, online courses are popping up to teach employees how to use the new AI tech. If AI is creating online courses to teach AI to humans then isn’t that a conflict of interest from AIs perspective?! If a tree falls in the forest and nobody hears it then…my brain hurts! This AI thing might take a while to understand.

GDP, unemployment rate, housing starts, an inverted yield curve, and inflation rate are all economic indicators of one sort or another. Fascinating, you inquire, tell me more. Economic indicators inform economists, companies, and investors of not only where the economy is today but perhaps where the economy may be headed, according to Investopedia. One economic indicator that may be signaling an oncoming recession: Soft demand for cardboard boxes. Data from the Fibre Box Assn. (I bet they have wild industry conferences) suggest that demand for corrugated linerboard…what most cardboard boxes are made from… has fallen in line with previous recessions. Meanwhile, the American Forest and Paper Assn. (rival assn. known for their rip roaring happy hours) reports that total boxboard production was down 5% in the first quarter, compared with 2022. You would think that weaker cardboard box demand signals weaker demand for goods. But service industries in developed economies like the U.S. remain resilient, which is cushioning the blow from the diminishing demand for physical goods. Many “experts” have forecasted a recession in 2023 or slowdown in 2024. Should that affect your investment plan longterm? Probably not unless you don’t know what you own. You should know what you own and if your asset allocation still fits your long term plans then it is always prudent to not time the short term swings in the market. Stay invested and don’t try to time your exit and entry into the markets and get crushed like a cardboard box!

Hey JB?

HEY JB - TV is horrible these days. Back when I was a kid we had Happy Days, Gilligans Island, and occasionally we could sneak in Three’s Company if my parents weren’t home. Now the only good thing on TV are the car insurance commercials. That darn Flo cracks me up. And Jake from State Farm seems like a cool dude! The Liberty Mutal guy with the Emu is weird, but I’m still entertained. Even though I love the commercials, I can’t stand that my car insurance keeps going up each year. Any suggestions on how I can save some money on car insurance? Signed Fonzi Fan

Dear Fonzi Fan - Yes I miss the golden years of TV, and I could do without all the unrealistic “reality” TV. Buckle up, let’s talk car insurance.

#1 find your current policy online and understand your coverages

Shop comparatively - Get online or find an independent agent.

Consider only high quality insurers - avoid JimBob’s insurance co.

Take advantage of discounts - Bundle renters/homeowners with car

Buy a car that is relatively inexpensive to insure - not a Porsche

Improve your driving record - try not to hit stuff while driving

Raise your deductibles - shifts more costs to you if you have an accident but will lower your premiums

Keep adequate liability insurance - don’t get too cheap and leave yourself exposed

quote bit$

“AI will be the best or worst thing ever for humanity.”

- Elon Musk (pretty smart guy)

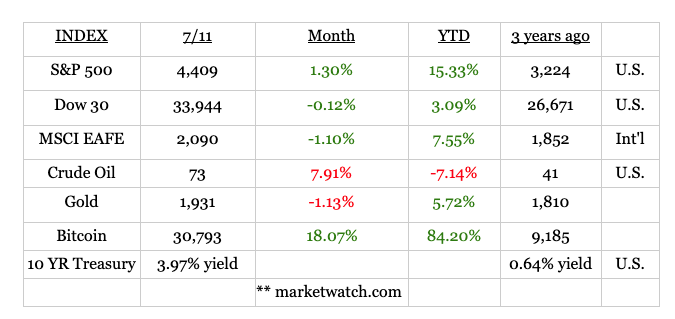

marketbit$

finbit$: The G.O.A.T. of basketball

His name inspires fear across the hardcourt. He is often referred to as the G.O.A.T. of basketball. Jordan has been loved by fans and feared by opponents for decades. At 6ft 6in, his “airness” could fly through the air and dunk it on anyone and everyone during his Hall of Fame career. He’s back! Or is he? Jordan is apparently going to enter the NBA draft Thursday night via a loophole in the NBA language. Oh not that Michael Jordan. I meant 5ft 7in, no talent, zero flying ability, law school student Jordan Haber. The “other” Jordan is a TikTok phenom and was bored and decided to read the NBA agreement to file for the upcoming draft. Personally when I’m bored I take a nap, hit golf balls, scrapbook, knit socks; however, reading a 273 page legal document has never crossed my mind. Apparently Jordan #2 found a loophole, filed the paperwork, and is now one of 300 “athletes” eligible for the NBA draft. He doesn’t expect to get drafted, but he has started doing push-ups in case he is asked to put on a jersey and walk across the stage. Stay tuned!

What’s your gig? Do you have a side hustle? If you operate in the gig economy are you saving enough for retirement? Gig workers typically don’t have a company retirement plan so they have to establish one for themselves. Two popular options are a Solo 401k or a SEP IRA. Both plans allow you to contribute money pre-tax which can reduce your overall tax burden. In 2023 you can contribute 25% of your business income into a SEP (self employed pension) IRA up to $66,000. The snag with a SEP IRA is that you have to treat all employees the same and contributionsIf you provide 5 percent of the company’s income to yourself, you also need to do so for any employees who qualify for the program. So while a SEP IRA lets you stash the cash as a sole proprietor, it might be a less attractive option as your business grows. A Solo 401k is a viable option if you’re a one person show and can contribute up to $66,000. A Solo 401k is a little more complex, but you can also set up a Roth 401k too.

Hey JB?

HEY JB? - Guacamole! Who can ever afford guac on their burrito. Since my student loan repayments have been paused during Covid because of my benevolent government, I’ve been flush with cash. I’m adding guac to everything. Do you know when this forbearance thingy ends because I might have to retreat back to free salsa instead of the extravagant guac?

Signed Student Loan Slacker

Dear Student Loan Slacker - You do realize at some point you were going to have to pay back your student loans. Your ‘benevolent’ government is still big brother and they want their money. As it stands now the federal student loan payment pause will expire — once and for all — this fall. Interest will begin accruing on Sept. 1, and borrowers will need to start making payments in October. Because of the debt ceiling deal passed by Congress on June 2, there’s no chance of further payment pause extensions. Translation…you definitely will start paying back your loans. The interest-free payment pause, known as forbearance, began as an emergency pandemic measure in March 2020 under President Trump. Your friends in D.C. did extend the pause for three years with nine extensions. Meanwhile, legal experts expect the Supreme Court to wrastle with the issue by late June or early July. Even if Papa Joe Biden's plan would erase your debt completely, take time now to prepare for payments — so you’re not scrambling at the last minute if the plan falls.

quote bit$

“Economists report that a college education adds many thousands of dollars to a man’s lifetime income – which he then spends sending his son to college.” – Bill Vaughn

finbit$: The great debate

The great debate is upon us. No it’s not boxers vs briefs. Reese’s vs Snickers. Or Captain Crunch vs Fruity Pebbles. It’s helmet vs no helmet. It turns out mandatory bicycle helmet laws could make cyclists less safe. The NTSB (National Transportation Safety Board) recently recommended all 50 states mandate helmet laws. I absolutely think everybody should protect their noggin with a helmet every time they hop on the two wheeler. However there have been some downsides with mandates. In Seattle, the bike share program saw a decrease in numbers when mandates were implemented. When cyclist numbers decrease, cars are less likely to pay attention to a few random bikers. Same with cities in Australia that enforced helmet laws which saw a decrease in cyclists causing the unintended consequence of reduced awareness of bikers. The solution is continued education to highly encourage wearing a helmet. And as a bonus put a $5 taillight on that helmet to add increased visibility to that oversized dome of yours. As someone who has done an endo over the handlebars a few times, I highly recommend helmets at all times. Now go for a ride!

It’s that time of year when I council, advise, demand, and beg my family to lowering our spending. Full disclosure, as a Dad, it’s always “that” time of year. Tense negotiations begin and it’s ultimately me against the family. As the primary revenue generator I feel like I should have more say…I don’t. Don’t get me wrong my wife is a fiscal rockstar. My adultish kids are pretty darn good but there are still some loose ends, random subscriptions, and unplanned expenses that I’d like to reign it in. “Hey Dad why don’t we just increase our debt ceiling like the government?” is one unexpected argument that I quickly shoot down. “Well sweetie,” I begin… WE have to be fiscally responsible and balance our budget and aim to run a surplus unlike our elected leaders!”, I retort in this unrealistic conversation. Yes its that time of the decade that Congress and the White House play chicken with our economy by dancing with the debt ceiling. Two opposing parties that can’t balance a checkbook and we leave the largest economy in the world in their hands. They’ll fix it. The Dems don’t want to reduce any spending and the Repubs don’t want to increase the debt ceiling by a penny, but somehow they will politicize down to the 11th hour and then they’ll either put in a short term fix or compromise. But what if they didn’t? Well the US would default on their loans that other countries and millions of individuals rely upon. Our credit rating would take a hit and our interest payments would go up much like if you missed a car payment or two. More than 70% of investors think the debt ceiling will get resolved according to a survey last week by Bank of America. But what if it doesn’t? Well not to be a negative Natalie, but the billions of dollars we already make in interest payments would increase dramatically causing our markets and economy to slide and further burdening our children to pay for it. It’s pure politics. Each side has to act tough for their constituents, but I assume they already have it figured out behind closed doors. It’ll probably be the bottom of the 9th inning before they solve it or possibly extra innings if they push a short term bandaid into the fall, but it will get fixed. And then both sides will claim victory and we’ll go on to the next topic. Now if I can just bring my family to the negotiating table without conceding too much!

Hey JB?

HEY JB - I love the government. I’m so happy at everything they provide for me, while asking nothing in return other than occasional sales tax, gas tax, income tax, property tax, and soda tax. Streetlights, firefighters, pothole repair, and exceptional service at the IRS. As my wife and I move into the next chapter of our lives, we may need Uncle Sam to add medical care and long term care to its neverending thoughtfulness. Will our all knowing benevolent government take care of us with our Medicare benefits at age 65 or should we look at other options? Signed Gov’t enthusiast

Dear Gov’t enthusiast - Wow. You’re a government's model citizen. I’m sure the government has our best interest in mind, but it doesn’t hurt to have a backup plan. A common misconception is that Medicare at age 65 will pay if you need long term care whether in a facility or your own home. It doesn’t cover you for long. Medicare may pay for 90 days in a skilled nursing facility if deemed medically necessary but then you’re on your own. Retirement accounts, proceeds from the sale of your primary home, and long term care insurance policies are all potential solutions to cover medical costs. Prepare a long term care plan in case you or your spouse should need assistance. As I’m navigating the potholes in the road, I’m not sure your benevolent government will always be there to fix your financial potholes that will come up in retirement.

quote bit$

“Always remember that hindsight is the best insight to foresight.” - Irish Proverb

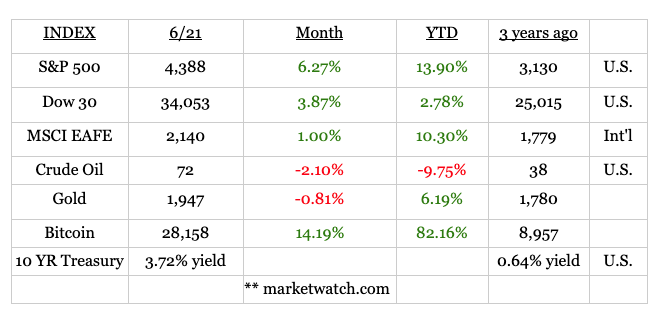

marketbit$

finbit$: Will AI make my job obsolete?

So I informed my wife yesterday that AI would make her obsolete in the near future. Yes we’re still married, but our conversation went downhill from there! You’d think after 30 years of marriage I’d learn to filter the limited thoughts from my brain to my lips. Nope. We were having a family discussion about ChatGpt, the AI software that is changing the world. It can write books, create music, and analyze financial documents. Therefore I made the comment that her job as an accountant would be obsolete. What I meant to say is “Many professions will incorporate AI more and more which may lead to certain professions changing dramatically and possibly being eliminated entirely.” What my dipstick mouth said was…”You’re gonna be obsolete soon!” She fired back with you’re gonna be obsolete sooner! Glad I wasn’t standing in front of her SUV or she may have finished me off right then. All in good fun. Yes she appreciated dinner out that night and the couch was reasonably comfortable that night.

We’re #1. We’re still pretty much #1! Well ‘Merica is trying to stay on top with the strength of the U.S. dollar, but we’re starting to slip. According to the Intercontinental Exchange (ICE) U.S. Dollar Index, which is a gauge of the U.S. greenback against a basket of major currencies, the U.S. dollar peaked in September of 2022 and has declined about 11%. Is that a bad thing? What in the heck am I talking about? When the U.S. dollar is strong it allows us to buy foreign goods for a cheaper price. Your croissant that you had in France last fall cost less than if you bought it today in Paris. However it makes exports like Ford F150s more expensive for purchasers outside of the U.S. If the dollar starts to decline then your pint of Guiness might cost more this year if you travel to Dublin, but for U.S. exporters it makes our products more attractively priced. It’s a balancing act that we can’t necessarily control. What’s your point JB? My point is that as an investor we tend to have a home country bias. I’m as much of a U.S. homer as anybody, byt it is also prudent to consider international funds as a part of your portfolio as currencies and economies fluctuate. Everyone’s risk tolerance and time horizon is personal, so consider all factors before making a change.

Hey JB?

HEY JB? - I’m thinking of canceling myself before someone does it for me. I mean I haven’t done or said anything horribly terrible that I’m aware of, but its just a matter of time for all of us. Before I completely cancel myself, I thought I’d reign in my credit cards and cancel a few. Probably don’t need my Star Trek Visa that I got at ComicCon last year or my Hello Kitty Platinum card that I’ve kind of outgrown. Does closing a credit card affect my credit score or ability to get more credit? Signed Trekkie for life

Dear Trekkie - Quite the dynamic having a Trekkie card and a Hello Kitty card! Whom am I to judge?! Yes you should reduce the amount of credit cards you have to simplify your finances. If you cancel a card it could impact your credit score temporarily because it will reduce the available credit you have. The credit bureaus may look at your financial ratios and decide your score should go down because you don’t have as much open credit available. That’s not a terrible thing if your spending habits are out of control. Also you could switch products with the same card provider. For example switch from a card with an annual fee to no fee or from a high annual interest rate to something more competitive. If you have more then two cards, then you probably have too many. Be smart and just keep the cards that make sense for you. Not sure anybody needs a Hello Kitty Platinum!

quote bit$

“Son, if you really want something in this life, you have to work for it. Now quiet! They’re about to announce the lottery numbers.” - Homer Simpson passing along financial wisdom to son Bart

marketbit$

finbit$: It’s not you, it’s me

“It’s not you, it’s me.” How many times have I heard that over my lifetime! Well this time I’m on the other end and it’s definitely not me, it’s you. I’m finally ready to dump them but it’s near impossible. Not that they will turn into stalker crazy and egg my car, but they just won’t let me go. I call and get put on hold for hours. I’ve tried online, but the message just never gets to them that I’m done! I wish I could just text and dump them and be done with it. Thank goodness our Congress is going to step in and help. Say what? Yep “that” Congress to the rescue. Cable, makeup, streaming, meal prep, books, and workout gyms are hard if not impossible to cancel subscriptions. One large workout chain allows you to easily sign up online, but to dump them you have to go in person to a gym. Who wants to show their face at the gym that they’ve been avoiding since the 2nd week of January when you gave up on your new year’s “get fit” resolution. Finally a bipartisan proposal is making its way through Congress to allow immediate, non-confrontational, and final breakups with that subscription that you forgot about until you see your credit card statement. Hopefully I can soon dump my unused gym membership, cable company, and pickle of the month club with a simple text.

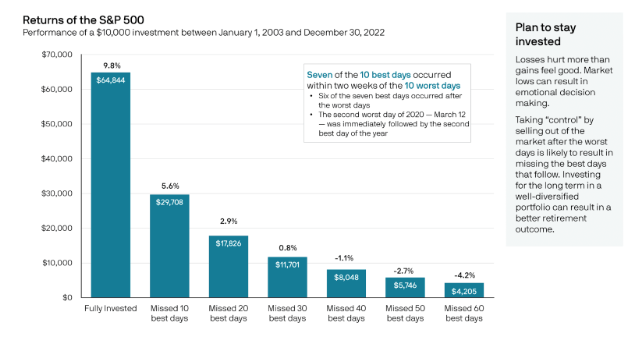

March Madness is over. Well we hope it’s over. Sure we had a few banks go south, but it seems the contagion of a run on the bank was contained when the respective governments jumped in quickly. So now what? Is it time to get out of the market and let this thing calm down for awhile? According to JP Morgan, the idea of getting in and out of the market often leads to missing the best days in the market.

Since 2003 if you stayed invested in the S&P 500 then your average return was just under 10%. If you tried to time the market and missed the 10 best days over those 20 years your return is almost cut in half down to 5.6% on average. If you thought you were brilliant and really tried to time the market and missed the best 50 days out of 7,300 days (365 x 20 for those of you keeping track), then your return was actually -2.7% on average. Seven of the 10 best days in the S&P 500 occurred within two weeks of the 10 worst days. Am I getting through that thick noggin of yours? If you can withstand the natural ups/downs of the market over the long haul then history shows us that you should be rewarded. If you try and time the market remember you have to be right twice. When to get out of the market and when to get back in. As a husband…I am rarely correct once so I can’t imagine how to be right twice!

Hey JB?

Hey JB - Are you watching the Master’s Tournament this weekend? I’ve got two TVs and my laptop set up to watch Tiger, Phil, Rory and all the up-and-comers. I went out and got a new $450 putter so I can practice in the family room while the pros put on a show. My wife is totally on board too and said as long as I watch Junior, do the laundry, cook dinner, get life insurance, and don’t invite any buddies over I can watch for 2 hours a day. I guess I can do all that stuff, but this life insurance stuff is daunting and boring. Now that we have a 10 month old son, I guess I need to man up. My life insurance buddy keeps pushing me on whole life insurance but it seems expensive. What should I get? What’s right for our family?

Signed - Can I Just watch golf?!

Dear “Can I just watch golf?! - First of all, unfortunately, we all have at least one life insurance buddy! What’s right for your family? It Depends. Life insurance is not a one size fits all. How much you need depends on how much you want income that you want to protect and for how long? How much do you earn? How much do you spend? What debt obligations do you have now and in the future? Kids college, mortgage, weddings, income replacement... Start with the amount you need to cover your financial obligations and then back into the right amount of coverage. Talk to an objective planner to help determine the amount and type before you look at products? Term insurance is much less expensive and might be the right solution for a young family. Remember life insurance is NOT FOR YOU. It’s for your loved ones that you leave behind if you were to drive your golf cart into the pond!

quote bit$

It’s not timing the market, it’s time in the market.

marketbit$