finbit$: It’s not you, it’s me

“It’s not you, it’s me.” How many times have I heard that over my lifetime! Well this time I’m on the other end and it’s definitely not me, it’s you. I’m finally ready to dump them but it’s near impossible. Not that they will turn into stalker crazy and egg my car, but they just won’t let me go. I call and get put on hold for hours. I’ve tried online, but the message just never gets to them that I’m done! I wish I could just text and dump them and be done with it. Thank goodness our Congress is going to step in and help. Say what? Yep “that” Congress to the rescue. Cable, makeup, streaming, meal prep, books, and workout gyms are hard if not impossible to cancel subscriptions. One large workout chain allows you to easily sign up online, but to dump them you have to go in person to a gym. Who wants to show their face at the gym that they’ve been avoiding since the 2nd week of January when you gave up on your new year’s “get fit” resolution. Finally a bipartisan proposal is making its way through Congress to allow immediate, non-confrontational, and final breakups with that subscription that you forgot about until you see your credit card statement. Hopefully I can soon dump my unused gym membership, cable company, and pickle of the month club with a simple text.

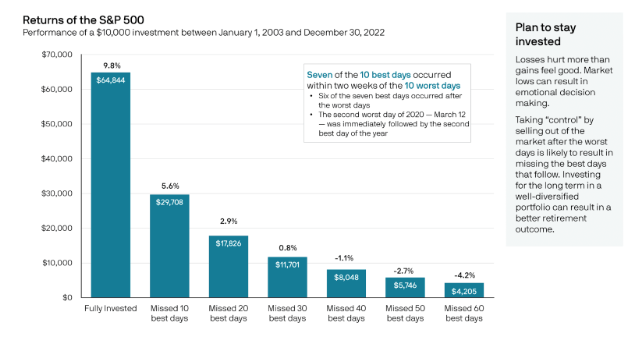

March Madness is over. Well we hope it’s over. Sure we had a few banks go south, but it seems the contagion of a run on the bank was contained when the respective governments jumped in quickly. So now what? Is it time to get out of the market and let this thing calm down for awhile? According to JP Morgan, the idea of getting in and out of the market often leads to missing the best days in the market.

Since 2003 if you stayed invested in the S&P 500 then your average return was just under 10%. If you tried to time the market and missed the 10 best days over those 20 years your return is almost cut in half down to 5.6% on average. If you thought you were brilliant and really tried to time the market and missed the best 50 days out of 7,300 days (365 x 20 for those of you keeping track), then your return was actually -2.7% on average. Seven of the 10 best days in the S&P 500 occurred within two weeks of the 10 worst days. Am I getting through that thick noggin of yours? If you can withstand the natural ups/downs of the market over the long haul then history shows us that you should be rewarded. If you try and time the market remember you have to be right twice. When to get out of the market and when to get back in. As a husband…I am rarely correct once so I can’t imagine how to be right twice!

Hey JB?

Hey JB - Are you watching the Master’s Tournament this weekend? I’ve got two TVs and my laptop set up to watch Tiger, Phil, Rory and all the up-and-comers. I went out and got a new $450 putter so I can practice in the family room while the pros put on a show. My wife is totally on board too and said as long as I watch Junior, do the laundry, cook dinner, get life insurance, and don’t invite any buddies over I can watch for 2 hours a day. I guess I can do all that stuff, but this life insurance stuff is daunting and boring. Now that we have a 10 month old son, I guess I need to man up. My life insurance buddy keeps pushing me on whole life insurance but it seems expensive. What should I get? What’s right for our family?

Signed - Can I Just watch golf?!

Dear “Can I just watch golf?! - First of all, unfortunately, we all have at least one life insurance buddy! What’s right for your family? It Depends. Life insurance is not a one size fits all. How much you need depends on how much you want income that you want to protect and for how long? How much do you earn? How much do you spend? What debt obligations do you have now and in the future? Kids college, mortgage, weddings, income replacement... Start with the amount you need to cover your financial obligations and then back into the right amount of coverage. Talk to an objective planner to help determine the amount and type before you look at products? Term insurance is much less expensive and might be the right solution for a young family. Remember life insurance is NOT FOR YOU. It’s for your loved ones that you leave behind if you were to drive your golf cart into the pond!

quote bit$

It’s not timing the market, it’s time in the market.

marketbit$