finbit$: The great debate

The great debate is upon us. No it’s not boxers vs briefs. Reese’s vs Snickers. Or Captain Crunch vs Fruity Pebbles. It’s helmet vs no helmet. It turns out mandatory bicycle helmet laws could make cyclists less safe. The NTSB (National Transportation Safety Board) recently recommended all 50 states mandate helmet laws. I absolutely think everybody should protect their noggin with a helmet every time they hop on the two wheeler. However there have been some downsides with mandates. In Seattle, the bike share program saw a decrease in numbers when mandates were implemented. When cyclist numbers decrease, cars are less likely to pay attention to a few random bikers. Same with cities in Australia that enforced helmet laws which saw a decrease in cyclists causing the unintended consequence of reduced awareness of bikers. The solution is continued education to highly encourage wearing a helmet. And as a bonus put a $5 taillight on that helmet to add increased visibility to that oversized dome of yours. As someone who has done an endo over the handlebars a few times, I highly recommend helmets at all times. Now go for a ride!

It’s that time of year when I council, advise, demand, and beg my family to lowering our spending. Full disclosure, as a Dad, it’s always “that” time of year. Tense negotiations begin and it’s ultimately me against the family. As the primary revenue generator I feel like I should have more say…I don’t. Don’t get me wrong my wife is a fiscal rockstar. My adultish kids are pretty darn good but there are still some loose ends, random subscriptions, and unplanned expenses that I’d like to reign it in. “Hey Dad why don’t we just increase our debt ceiling like the government?” is one unexpected argument that I quickly shoot down. “Well sweetie,” I begin… WE have to be fiscally responsible and balance our budget and aim to run a surplus unlike our elected leaders!”, I retort in this unrealistic conversation. Yes its that time of the decade that Congress and the White House play chicken with our economy by dancing with the debt ceiling. Two opposing parties that can’t balance a checkbook and we leave the largest economy in the world in their hands. They’ll fix it. The Dems don’t want to reduce any spending and the Repubs don’t want to increase the debt ceiling by a penny, but somehow they will politicize down to the 11th hour and then they’ll either put in a short term fix or compromise. But what if they didn’t? Well the US would default on their loans that other countries and millions of individuals rely upon. Our credit rating would take a hit and our interest payments would go up much like if you missed a car payment or two. More than 70% of investors think the debt ceiling will get resolved according to a survey last week by Bank of America. But what if it doesn’t? Well not to be a negative Natalie, but the billions of dollars we already make in interest payments would increase dramatically causing our markets and economy to slide and further burdening our children to pay for it. It’s pure politics. Each side has to act tough for their constituents, but I assume they already have it figured out behind closed doors. It’ll probably be the bottom of the 9th inning before they solve it or possibly extra innings if they push a short term bandaid into the fall, but it will get fixed. And then both sides will claim victory and we’ll go on to the next topic. Now if I can just bring my family to the negotiating table without conceding too much!

Hey JB?

HEY JB - I love the government. I’m so happy at everything they provide for me, while asking nothing in return other than occasional sales tax, gas tax, income tax, property tax, and soda tax. Streetlights, firefighters, pothole repair, and exceptional service at the IRS. As my wife and I move into the next chapter of our lives, we may need Uncle Sam to add medical care and long term care to its neverending thoughtfulness. Will our all knowing benevolent government take care of us with our Medicare benefits at age 65 or should we look at other options? Signed Gov’t enthusiast

Dear Gov’t enthusiast - Wow. You’re a government's model citizen. I’m sure the government has our best interest in mind, but it doesn’t hurt to have a backup plan. A common misconception is that Medicare at age 65 will pay if you need long term care whether in a facility or your own home. It doesn’t cover you for long. Medicare may pay for 90 days in a skilled nursing facility if deemed medically necessary but then you’re on your own. Retirement accounts, proceeds from the sale of your primary home, and long term care insurance policies are all potential solutions to cover medical costs. Prepare a long term care plan in case you or your spouse should need assistance. As I’m navigating the potholes in the road, I’m not sure your benevolent government will always be there to fix your financial potholes that will come up in retirement.

quote bit$

“Always remember that hindsight is the best insight to foresight.” - Irish Proverb

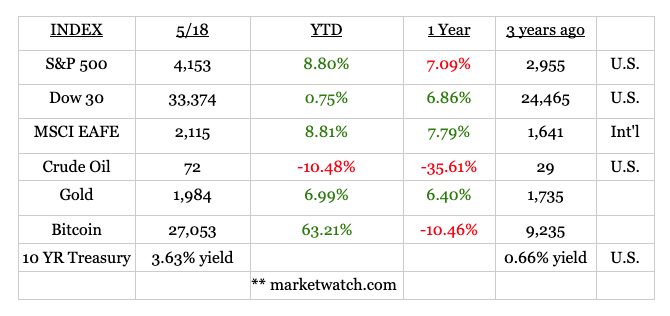

marketbit$