finbit$: I’ll admit it, I’m a Swiftie!

A $5 billion economy is not bad for a country. In fact that number ranks you in the top 50 economies worldwide. Although this “mobile economy” is not a country, more like a phenomenon. Yes I had to work in Taylor Swift this week. Her ERA’s tour is not only the biggest thing going, but move over Elton John it could be the biggest concert tour ever. She opened in Glendale, AZ this past spring of 2023, and her first show brought in more moolah then the Super Bowl which was played in February in the same stadium. In fact she’s been playing the equivalent of 2-3 super bowls every weekend for the last 6 months (I bet Travis couldn’t play that many super bowls). Analysts expect her earnings from the ERA’s tour to surpass the $1 billion mark by March of 2024 and possibly $5 billion of revenue for the cities she takes over! Shockingly, analysts are wrong a lot, but I have to put this educated guess in the “Strong Buy” category. She’s a machine! Swift writes her own songs, is protective of her music via streaming, and is re-releasing her songs to reclaim her master rights. Awesome! If your daughter, son, or grandpa needs a role model then I’d consider becoming a Swiftie. Recently she’s been rumored to be dating Travis Kelce, all pro tight end for the KC Chiefs. I love Kelce, but dude she’s way out of your league. My guess is that Taylor will “shake off” Travis faster then a middle linebacker blows up a receiver crossing the middle. Sorry Kelce, we know “All Too Well” that Swift is “Fearless” and may not fall for your “Sweet Nothing(s)”. Ok I fit in half a dozen songs, that’s enough. Stay tuned to see what happens next to America’s latest power couple.

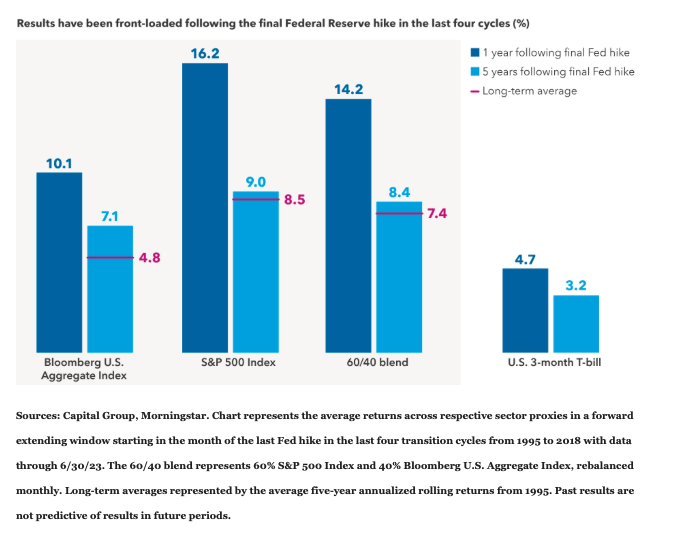

Yes, yes I know we barely averted a government shutdown this past weekend. And yes increased inflation is hanging around. And the Denver Broncos are a complete disaster. And last year was a bit of an outlier in the markets, since it was the first time in 45 years that both stocks and bonds posted negative returns. The Fed was aggressively raising interest rates to cool off inflation, but will they continue with the increases? Inquiring minds want to know! It seems the Fed is signaling they are pausing rates at the 5.25%-5.50% range. And they might be near the end of rate hikes, so the question is now what to do with your boatload of cash? I am not giving investment advice because everyone is different. Nolo Advice-o! What I’m showing you in the chart below from the Capital Group is what has happened after the last four rate hike cycles. Wow fascinating!!

If rates pause or even retreat a smidgen in 2024 it can help both stocks and bonds theoretically. As companies and consumers see their borrowing costs flatten and maybe even decline, it provides a boost to the economy and corporate profits. Historically, equity investors have seen the benefit. The bond market might also benefit if rates retreated and you owned bonds that were paying a higher interest rate then the current rate. What I’m saying is sometimes you have to be patient and look at history. Nobody knows what the next 12 months will look like in the markets, so sticking to your long term plan may be the best non-move you ever made!

Hey JB?

Hey JB - I’m 33, married, my fantasy football teams stinks, and we now have a 10 month old son. I’m not blaming Junior for my draft woes, but next year I’m definitely not taking a punter in the first round. My wife says I need to quit sports betting and get some life insurance in case I ski off the wrong cliff this winter. Harsh, I know! My buddy keeps pushing me on this whole life insurance, but it seems like a whole lot of money. What should I get? What’s right for our family? - signed “Shoulda taken Mahomes”

Dear “Shoulda taken Mahomes” - The answer is ALWAYS take Mahomes for your fantasy league. As far as life insurance, it is not a one size fits all. How much you need depends on how much you want to protect and for how long? How much do you earn? How much do you spend? What debt obligations do you have now and in the future? Kids college, mortgage, weddings, income replacement... Start with what you need to cover these obligations and then back into an amount. For young families, 20 year term insurance is an inexpensive way to cover your loved ones if you pass away prematurely... aka go off the wrong cliff. Talk to an objective financial planner to help determine the amount and type before you look at products.

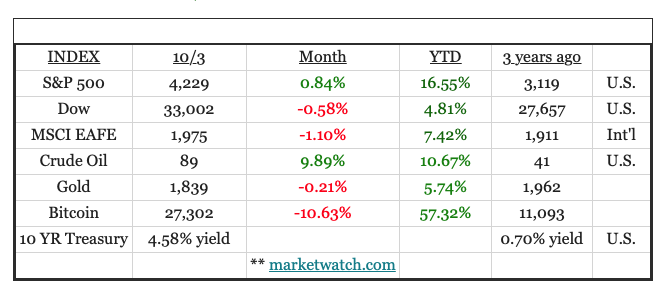

market bit$

quote bit$

“This year I invested in pumpkins. They’ve been going up the whole month of October and I got a feeling they’re going to peak right around January. Then bang! That’s when I’ll cash in.”

- Homer Simpson (dimwitted donut eating dad of Simpon’s cartoon fame)